-

FinCEN’s BOI Reporting Deadline: Berryville, AR Businesses Must File by 01/01/2025

Offer Valid: 11/27/2024 - 11/27/2026

The Corporate Transparency Act (CTA) mandates Berryville, AR businesses to report Beneficial Ownership Information (BOI) to FinCEN to enhance financial transparency and combat illegal activities like tax evasion and money laundering.As of today, 11-26-2024, Berryville business owners have 36 calendar days (or 27 business days) left to file their BOI reports with FinCEN—don’t delay, as fines of $500 per day may apply!

Steps for Compliance

1. Check If Your Business Needs to File

Deadline: ASAP

Most U.S. LLCs, corporations, and similar entities must file unless exempt (e.g., publicly traded companies, charities).2. Identify Your Beneficial Owners

Deadline: 12-10-2024

Beneficial owners include those who:-

Own 25% or more of the company, or

-

Exert substantial control over decisions.

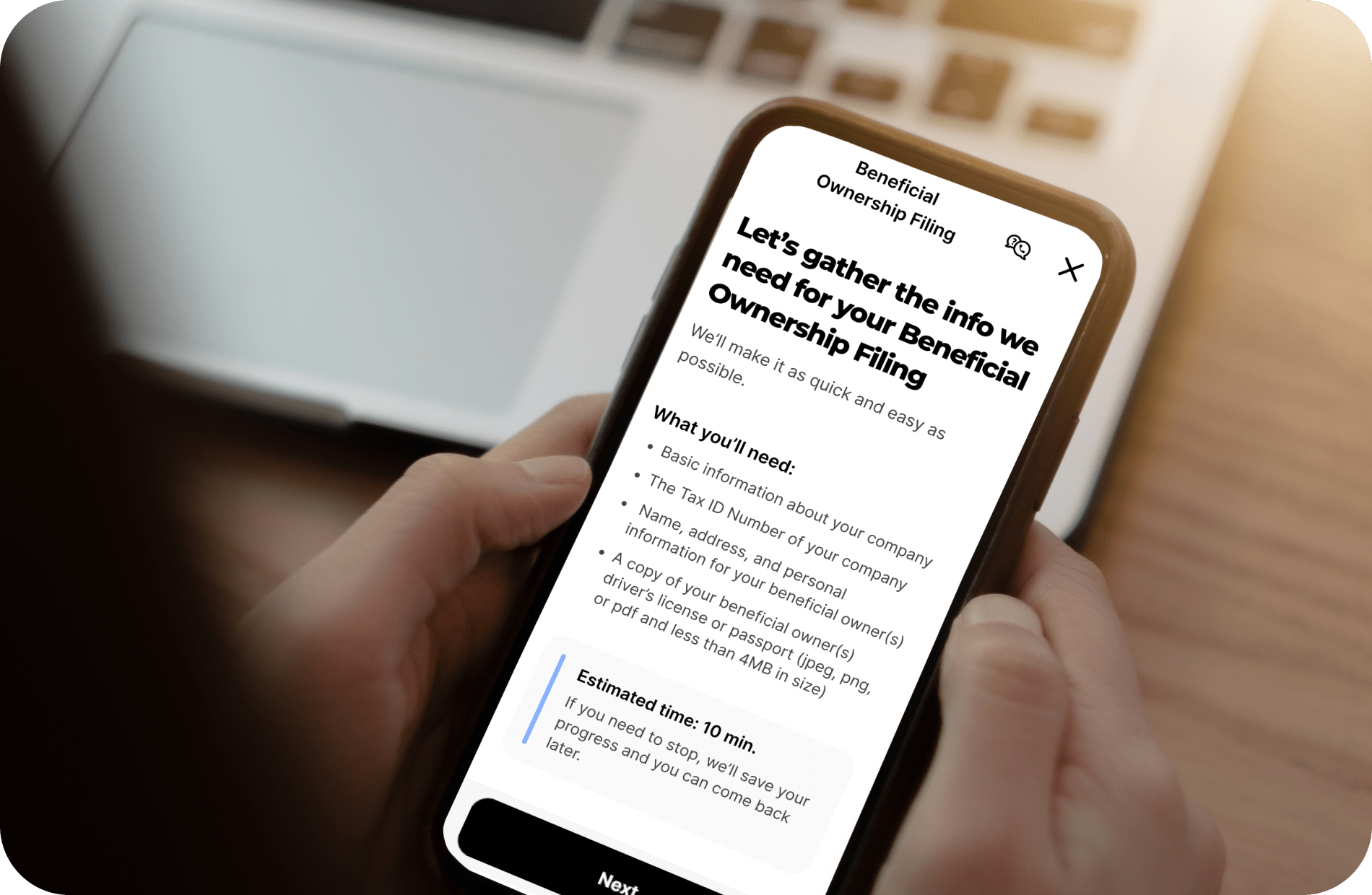

3. Prepare the Required Information

Deadline: 12-17-2024

Collect:-

Company Details: Legal name, EIN, address.

-

Owner Information: Names, birthdates, addresses, and ID details.

4. File Your BOI Report

Deadlines:

-

Existing businesses: 01/01/2025

-

New entities (2024): 90 days after formation

-

New entities (2025 and beyond): 30 days after formation

ZenBusiness can assist with fast and accurate BOI filing—get started today.

BOI Filing: What Berryville Businesses Should Know

Who Needs to File?

A "reporting company" is any LLC or corporation registered in the U.S., except for exempt entities like banks, charities, or publicly traded companies. For example, a local Berryville bakery operating as an LLC must file.

Who Qualifies as a Beneficial Owner?

A beneficial owner is defined as someone who:

-

Exerts significant control over company operations, or

-

Holds at least 25% of ownership interest.

Example: In a Berryville landscaping LLC, the owner holding 30% of shares and managing operations qualifies as a beneficial owner.

What Information Is Required?

Your BOI report must include:

-

Company Information: Name, EIN, address.

-

Beneficial Owner Information: Full names, birthdates, residential addresses, and identification details.

Filing Process and Deadlines

BOI reports are submitted electronically via FinCEN’s online portal. Deadlines are based on formation date:

-

Existing companies: 01/01/2025

-

New entities formed in 2024: 90 days after registration

-

Entities formed after 2025: 30 days after registration

Consequences of Non-Compliance

Failure to file or providing false information could result in:

-

Fines of $500 per day.

-

Potential criminal penalties.

Mistakes can be corrected under a 90-day safe harbor period.

How ZenBusiness Can Help

ZenBusiness offers professional support for preparing and filing BOI reports, ensuring compliance and saving time for Berryville businesses. Their expertise ensures accuracy and peace of mind. Learn more—click here.

Additional BOI Filing Resources

Don’t let the 01/01/2025 deadline pass—file your BOI report today to avoid costly penalties!

Additional Hot Deals available from ZenBusiness

This Hot Deal is promoted by Greater Berryville Area Chamber of Commerce.

Tell a Friend

-

-

Check out our recent issue of "The Berryville Chamber eNews" by clicking here